UAE Gratuity Calculator 2026: Based on UAE Labor Law

هل تساءلت يومًا عن قيمة مستحقاتك عند انتهاء عقد عملك في الإمارات العربية المتحدة؟ لحسن الحظ، مع حاسبة مكافأة نهاية الخدمة في الإمارات، يمكنك الآن حساب مستحقاتك بسهولة ودقة وشفافية وفي دقائق معدودة. في هذه المدونة، سنرشدك إلى كل ما تحتاج معرفته حول حساب مكافأة نهاية الخدمة وفقًا لقانون العمل الإماراتي.

Table of Content

- 1 حاسبة الإكراميات في الإمارات العربية المتحدة

- 2 ما هي الإكرامية في الإمارات العربية المتحدة؟

- 3 كيفية استخدام حاسبة الإكراميات في الإمارات العربية المتحدة

- 4 حساب الإكرامية في الإمارات العربية المتحدة

- 5 Calculate the Gratuity of Part-Time Employees

- 6 Gratuity for UAE Nationals

- 7 Gratuity for Foreigners in the UAE

- 8 UAE Gratuity Calculation Formula for Limited Contracts

- 9 How to Determine the UAE Gratuity for an Infinite Contract

- 10 أمثلة على حساب الإكرامية في الإمارات العربية المتحدة

- 11 شروط الحصول على مكافأة نهاية الخدمة في دولة الإمارات العربية المتحدة

- 12 خاتمة

- 13 Questions & Answers

حاسبة الإكراميات في الإمارات العربية المتحدة

استخدم أحدث تعديلات قانون العمل لحساب مكافأة نهاية الخدمة في الإمارات العربية المتحدة بسهولة عبر الإنترنت. لحساب مكافآت نهاية الخدمة بسرعة ودقة، استخدم حاسبة مكافأة نهاية الخدمة عبر الإنترنت.

ما هي الإكرامية في الإمارات العربية المتحدة؟

تُعدّ مكافأة نهاية الخدمة في دولة الإمارات العربية المتحدة مبلغاً إلزامياً يتعين على أصحاب العمل دفعه لموظفيهم عند انتهاء خدمتهم. ويُحسب هذا المبلغ بناءً على مدة خدمة الموظف وراتبه الأساسي الأخير.

كيفية استخدام حاسبة الإكراميات في الإمارات العربية المتحدة

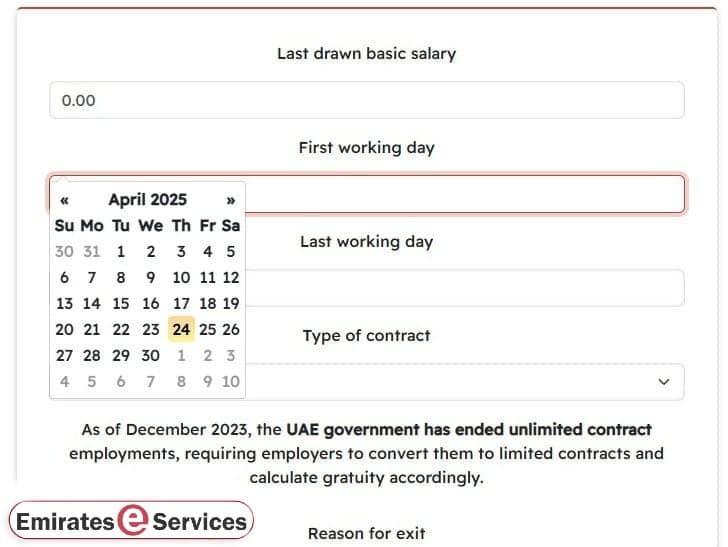

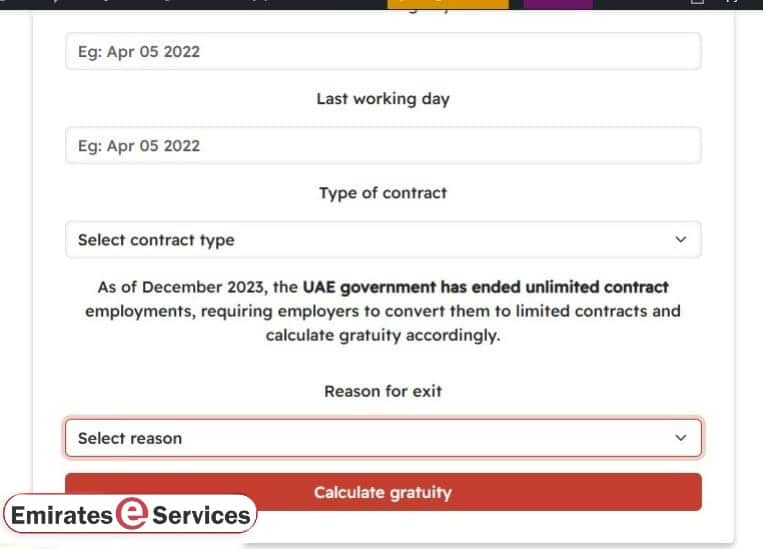

إليك كيفية استخدام حاسبة الإكراميات في الإمارات العربية المتحدة لتحديد إكراميتك:

- افتح الآلة الحاسبة.

- أدخل يوم العمل الذي استؤنف بموجب عقد العمل تحت عنوان “أول يوم عمل”.

- أدخل اليوم الذي انتهى فيه العمل، كما هو مذكور في أوراق الاستقالة، تحت عنوان “آخر يوم عمل”.

- يجب النقر على زر “الحساب”.

- بناءً على ما أدخلته، سيتم عرض قيمة الإكرامية لك.

حساب الإكرامية في الإمارات العربية المتحدة

إليك كيفية حساب الإكرامية في الإمارات العربية المتحدة:

- تحديد الأجر اليومي: قسّم الراتب الأساسي الشهري على 30. على سبيل المثال، إذا كان الراتب الأساسي 12000 درهم إماراتي:

- الأجر اليومي = 12,000 درهم إماراتي ÷ 30 = 500 درهم إماراتي

- حساب مكافأة نهاية الخدمة لأول 1 إلى 5 سنوات : بالنسبة لأول 1 إلى 5 سنوات، يتم حساب مكافأة نهاية الخدمة السنوية بضرب الأجر اليومي في 21. أي:

- مكافأة نهاية الخدمة = (الأجر اليومي × 21) × عدد السنوات.

- لحساب مكافأة نهاية الخدمة لأكثر من 5 سنوات: اضرب الأجر اليومي في 30 لكل سنة خدمة إضافية. أي:

- مكافأة نهاية الخدمة = (الأجر اليومي × 30) × عدد السنوات الإضافية.

- حساب إجمالي المكافأة: مكافأة السنوات الخمس الأولى + مكافأة السنوات الإضافية = إجمالي المكافأة.

Calculate the Gratuity of Part-Time Employees

Here’s how to calculate the gratuity of a part-time employee in the UAE:

- Calculate the Work Ratio: (Actual hours ÷ Full-time hours) × 100 = Work ratio. For example, if a part-time employee works 18 hours per week, and a full-time schedule is 36 hours per week:

- Work ratio = (18 ÷ 36) × 100 = 50%.

- Calculate gratuity for the first 1 to 5 years: For the first 1 to 5 years, calculate gratuity per year by multiplying the daily wage by 21. That is:

- Gratuity = (Daily wage × 21) × Number of years.

- Calculate gratuity for service beyond 5 years: Multiply the daily wage by 30 for each additional year of service. That is:

- Gratuity = (Daily wage × 30) × Number of additional years.

- Calculate full-time total gratuity: Gratuity for first 5 years + Gratuity for additional years = Total full-time gratuity.

- Calculate part-time gratuity: Full-time gratuity × (work ratio ÷ 100). For example, if the full-time gratuity is AED 50,000 and the work ratio is 50, then part part-time gratuity:

- 50,000 × (50 ÷ 100) = 25,000. In this case, the gratuity for part-time employees is AED 25,000.

Gratuity for UAE Nationals

Termination of Service: A gratuity is a benefit that an employer gives to a worker. This reward is determined in the United Arab Emirates once an employee has worked for the company for at least a year. The employee’s position inside the organization is one factor that needs to be considered in this respect. For instance, benefits provided to a UAE national in the private sector will be governed by the country’s social security and pension regulations.

Gratuity for Foreigners in the UAE

When a foreign employee’s employment comes to an end, the employer is required to give them a gratuity. This gratuity is given all at once. The guidelines for giving foreign workers an end-of-service gratuity are as follows:

- For the first five years of the employment relationship, twenty-one days’ compensation every year.

- 30 days’ pay for every year following the preceding one.

- If a foreign employee has worked continuously for at least a year, they are eligible to calculate this proportional gratuity as a fraction.

- Using the Dubai End of Service Gratuity Calculator, unpaid absence days are not taken into account when calculating the length of service.

UAE Gratuity Calculation Formula for Limited Contracts

The following formula is used in the United Arab Emirates to determine the end-of-service gratuity payout for limited contract employees:

- Last basic salary × 21 days × Number of years of service.

For instance, the bonus amount would be as follows if an employee worked for two years and their most recent base pay was AED 3,000:

- AED 3,000 × 21 days × 2 years = AED 126,000

How to Determine the UAE Gratuity for an Infinite Contract

في دولة الإمارات العربية المتحدة، يتم تحديد مكافآت نهاية الخدمة للعمال الذين لديهم عقود غير محددة المدة على النحو التالي:

- حدد الراتب الأساسي للموظف.

- حدد عدد السنوات التي عمل فيها الشخص في الشركة.

- لتحديد مبلغ مكافأة نهاية الخدمة، اضرب عدد سنوات الخدمة في 21 يومًا من الراتب الأساسي.

- اضرب عدد سنوات الخدمة في الراتب الأساسي لشهر واحد لتحديد قيمة المكافأة.

- يتم تحديد إجمالي مكافأة الموظف عن طريق جمع المجموعين.

أمثلة على حساب الإكرامية في الإمارات العربية المتحدة

- سيحصل العامل الذي يتقاضى راتباً أساسياً قدره 3000 درهم إماراتي ولديه 4 سنوات من الخدمة على ما يلي:

(21 × 3000 × 4) ÷ 30 = 8400 درهم إماراتي

- شخص يتقاضى راتباً أساسياً قدره 5000 درهم إماراتي ولديه 11 عاماً من الخدمة:

(30 × 5000 × 11) ÷ 30 = 55000 درهم إماراتي

شروط الحصول على مكافأة نهاية الخدمة في دولة الإمارات العربية المتحدة

في دولة الإمارات العربية المتحدة، تحدد الظروف والعناصر التالية أهلية الشخص للحصول على مكافأة:

- لا تُمنح الإكراميات إلا للعاملين الذين عملوا في نفس الشركة بشكل مستمر لمدة عام على الأقل.

- لا تُمنح الإكراميات للموظفين الذين عملوا لمدة تقل عن عام.

- تُطبق أحكام الإكرامية على العمال الأجانب بدوام كامل في القطاع الخاص.

- ولأنهم مشمولون ببرنامج المعاشات التقاعدية الوطني، فإن مواطني دولة الإمارات العربية المتحدة غير مؤهلين للحصول على مكافآت.

- قد لا يكون العمال الذين يتم فصلهم بسبب سوء سلوك خطير مؤهلين للحصول على مكافآت.

- بعد مرور عام على الخدمة، يحق للموظفين الذين يستقيلون أو يتم فصلهم (ليس بسبب سوء السلوك) الحصول على مكافأة.

- يجب ألا يتجاوز إجمالي مبلغ المكافأة الراتب الأساسي لمدة عامين.

- يتم استخدام آخر راتب أساسي تقاضيته، والذي لا يشمل العمولات أو بدلات السكن أو المواصلات، لحساب الإكرامية.

خاتمة

سواء كنت تخطط لخطوتك القادمة، أو تتفاوض على وظيفة جديدة، أو كنت فضوليًا فحسب، فإن معرفة قيمة إكراميتك تساعدك على إدارة أمورك المالية بفعالية. حاسبة الإكراميات في الإمارات العربية المتحدة تجعل البقاء على اطلاع دائم أمرًا في غاية السهولة. إنها ليست مجرد رقم، بل هي مكافأتك المستحقة عن سنوات من التفاني.

Questions & Answers

Gratuity is calculated based on the employee's last drawn basic salary and length of service.

Gratuity is calculated solely on the employee's last drawn basic salary, excluding allowances like housing, transportation, or commissions.

Yes, the total gratuity amount should not exceed the equivalent of two years' wages.

Full-time employees with 5 years of continuous service with one employer.